Merchant Platform FAQ

1. Multi-currency Fund Management

1.1 How long does it take for my account to be credited? What currencies are supported?

If the payment bank is a Hong Kong account, it is expected to arrive in T+0~T+1 days, if it is a bank in other regions it is expected to arrive in T+0~T+3 days. Supported top-up currencies can be viewed under Merchant Platform Menu.

1.2 What are the (settlement/withdrawal) fees?

Settlement Handling Fee is the settlement fee to be deducted when a merchant withdraws money, which is deducted according to the actual number of remittances, please consult your account manager for details.

1.3 If there is cross-currency settlement, what is the conversion rate?

Conversion rates are subject to change in real time, please contact your account manager for details.

1.4 How to prevent the payment operation from being affected due to untimely top-up?

If the balance of the payout account is insufficient, the payout order will fail, and the merchant needs to recharge or exchange funds to the target debit currency before resubmitting the order.

- In order to prevent the payout from being affected by insufficient account balance, merchants can use the Amount Alert function. Go to → → → on the merchant platform to configure the balance alert rules. When your account balance is less than or equal to the warning value, PayerMax will send an email notification, prompting you to top up or transfer funds. Regarding the , the alert amount only includes the available balance, and it is an alert for each currency account amount, not for the total account balance.

1.5 Account type and balance statistics logic

Each currency has a disbursement account、a to be settled account and a settled payment account

Disbursement Account —> Disbursement Amount:When the user makes a disbursement, the amount in the Disbursement Account will be used, and the amount in the escrow account can also be withdrawn

To Be Settled Account —> Amount to be Settled:The funds received by the merchant will first flow to the merchant's to be settled account, and after reaching the settlement cycle, the funds will be settled to the settled payment account.

Settled Payment Account —> Settled Payment Amount:The transaction has been completed and has reached the settlement cycle, the balance in the settled payment account can be withdrawn or transferred to top up the fund

The relationship between the amount displayed on the account balance page and each account type of the merchant's income and expenditure details is as follows:

Total Amount: Settled Payment Amount + Disbursement Amount

Settled Payment Amount: The transaction has been completed, the settlement cycle has been reached, the funds can be withdrawn or transferred to top up

Disbursement Amount: Merchant top-up funds, settlement transfer top-up funds, VA collection funds, can be used as a fund balance account for disbursement,withdrawal, transfer and exchange of foreign currency.

Amount to be Settled: Summary of transaction funds for transactions completed but not yet in the settlement account period

From the amount to be settled to enter the detailed query history of the amount to be settled, the amount of the day to be settled, the amount in the settlement, the operation path is as follows:

Historical Settlement Amount/Settlement Amount->Settlement - Settlement Order

Settlement amount of the day -> Payment - order search

Total Frozen amount: Funds account in the frozen funds after charge back disputes on payment transactions

Classification of funding flow scenarios:

| Flow of Funds | Scenario Name |

| Settled Payment Account —> Bank Card | Settlement to Card |

| Settled Payment Account —> Disbursement Account | Acquiring to Disbursement/Settlement to Disbursement |

| Disbursement Account —> Bank Card | Withdrawal |

1.6 Why is the available balance not the same as the actual amount paid during the top-up?

PayerMax currently only accepts USD on arrival. After receiving the amount calculated in USD, PayerMax will convert it to the target currency at the contracted exchange rate to top up your available balance account. PayerMax will refer to our exchange rate system for all types of exchange operations, please consult your Business Manager for details.

1.7 How to count the amount to be settled?Why doesn't it match the amount on the statement?

Amount to be settledis the amount to be settled for your collection transaction. The amount displayed on the page is the real-time amount in each currency at the time of query. The USD balance of non-USD currency accounts is for display purposes only;Amount in the settlement slipis the actual USD amount when you settle with us. The amount to be settled in each currency that meets the settlement conditions (reaching the settlement period, starting amount, working day) is converted into USD according to the exchange rate agreed in the contract and reflected in the settlement slip.

In summary, the amount displayed in Amount to be settled can only be used as a reference to check the approximate balance, and cannot be used as a basis for settlement reconciliation. If you need to reconcile the funds of the collection transaction, please refer to the settlement slip. If you need more information, please consult your business manager.

2. Global Payment

2.1 Order Enquiry

2.1.1 What if the enquiry order does not exist?

When ensuring that the order number is entered correctly, it still does not exist, the possible reasons are:

The user enters the till and exits quickly.

The network is slow and the user exits the till before the page is loaded. The above two situations will result in the merchant order number being generated, but not the platform order number. Therefore, the query order does not exist.

2.2 Refunds

2.2.1 Why can't I initiate a refund?

An order needs to meet the following conditions to initiate a refund:

Only successfully paid orders can be refunded

Orders already in the refund process cannot be refunded again

Orders that have been successfully refunded cannot be refunded again

Refund can be initiated within 180 days of successful order payment

Please ensure that the account balance is sufficient for the refund

Please confirm whether the operator has permission to request a refund. If the order does not meet the conditions but still need to be refunded, it is recommended to use PayerMax's disbursement service to refund. For more information, please contact service@payermax.com.

2.2.2 What is the handling fee for refund?

Administrators can check the payment method handling fee, responsible party and refund handling fee in → → in the merchant platform.

2.2.3 How long can the user expect to receive a refund?

The time frame for the refund to arrive depends on the time frame for the refund to arrive in the user's original payment method. Once you have successfully initiated a refund request, the refunded amount will usually be returned to the user's bank account within 21 days. Due to channel limitations, the actual arrival time varies from bank to bank.

2.2.4 To which account will the refunded amount be credited?

The refunded amount will be credited back to the user's account in the same manner as the original transaction. For example, if a user makes a payment through Paytm Wallet and the refund is successful, the amount will be credited back to the user's Paytm Wallet account.

2.2.5 Where is the refund amount deducted from? What if the refund balance is insufficient?

PayerMax will deduct the refund amount from your pending account (pending settlement amount), if the amount in the pending account (pending settlement amount) is insufficient, it will return REFUND_INSUFFICIENT_BALANCE, after receiving this error code, please wait until there is a successful payment transaction and initiate it again.

If the pending balance is insufficient and there is money on other currencies, you can contact the payermax staff for transfer processing.

2.2.6 Why does the refund show success, but the user does not receive the money?

A successful refund only means that the channel party has successfully accepted the refund application, and the specific arrival time varies depending on channel restrictions. After you successfully initiate a refund application, the refund amount is expected to be returned to the user's original payment account within 1-15 days. Restricted by the channel, the refund status is only used to check whether the acceptance is successful, and does not currently support querying the actual status of the refund process. However, each channel generally handles the refund according to the following rules: After the refund request is successfully accepted, the funds will be returned to the original payment account of the user within 1-15 days. If the user asks, you can answer the user according to the above caliber. If your problem cannot be solved, please report to PayerMax technical support for verification.

2.2.7 Can I re-initiate a refund for orders that were rejected and failed?

Yes. Both rejected and failed orders can be re-initiated as long as they are within the refund validity period.

2.2.8 Can I initiate a refund for an order that has already been settled?

Yes, you can. As long as the order meets the conditions for initiating a refund, even if it has already been settled, it will not affect the refund.

2.2.9 How to add refund approval function?

The refund approval function is used after a refund request is initiated, it requires review by other personnel in your company, Please contact PayerMax to add the approval function.

If not enabled yet, by default, after initiating a refund request, no approval is needed and the refund process can be executed directly, if you need enable it, please contact the admin account to log in the Merchant Platform and go to → page to add refund approval function.

If it’s already enabled, please contact the admin account (or other operators with “Users” function) to change your permission. For details, please refer to How to open Disbursement Refund Approval process.

2.2.10 When do merchants need to take the initiative to process refunds?

When the amount alert type is

Ethoca, and the merchant needs to actively process the refund;When the amount alert type is

EthocaorRDR, the platform automatically processes the refund, but the chargeback warning amount exceeds the threshold, and the merchant needs to process the chargeback warning order for the refund. The button will be displayed on the list page:

Click the button, and a pop-up window will display the refund information. For orders with a chargeback warning, only full refunds are supported. After confirming the refund information, click [Refund Request] to complete the refund. Please confirm the refund information carefully, as the refund cannot be canceled after it is accepted.

- When the chargeback warning type is

Ethoca, and the merchant needs to actively operate the refund, if you want to refuse the refund of the chargeback warning order, you can handle the refund rejectionwithin 24 hours. After the refund is rejected, the refund function will no longer be provided in the chargeback warning order page. The merchant can operate the refund through the → ; if the refund is not rejected within 24 hours, the system will no longer display the button, and the merchant will process the refund by default.

2.2.11 What's the difference between the refund, dispute anf chargeback?

Refund: It means that the user has purchased a product but is not satisfied with it, and asks the merchant for a refund. The user cannot skip the merchant for a refund. If the payment method itself supports refunds, this is supported. After the merchant agrees, the refund can be processed in the background or by calling our API.

Dispute: It refers to the behavior of users who have purchased products and raise objections to the completed transaction. It is usually believed that the transaction has problems such as unauthorized, inconsistent goods or services, and non-receipt of goods. The filing of a dispute will prompt the card issuer or payment platform to intervene in the investigation, and the seller can submit evidence to defend within a certain period of time.

Chargeback: It means that the user purchased a product, was dissatisfied or for other reasons, and the user directly contacted his card issuer to initiate a dispute. After the bank accepts the dispute, there will be a chargeback process. The merchant needs to provide relevant purchase and delivery records, and then the bank will arbitrate. If the merchant loses the case, the bank will return the money to the user. If the merchant wins the case, the bank will settle the money to you.

2.3 Settlement

Merchants use settlement management services when they need to query settlement cycles, settlement documents, settlement funds, or operate settlement funds.

2.3.1 Why are some orders not yet settled?

The settlement statement will not be generated until the successful order reaches the settlement cycle. You can check the settlement cycle of different payment methods by logging in to the merchant platform under → → .

2.3.2 Why did the application for settlement to the bank card fail?

The application settlement failure is generally due to the following two reasons:

Settlement to the card does not meet the minimum settlement amount (generally the minimum settlement amount is 1000USD, each time is 20USD handling fee);

Does not support settlement to card payment methods (such as non-CARD payment methods in Egypt)

If your problem cannot be solved, please report to PayerMax technical support for verification.

2.3.3 I have already applied for settlement to the card, how long will it take to get the account?

After submitting the application, the finance will be processed within T+3 days, and you can check the status update on the merchant platform.

2.3.4 How is the money to be settled generated?

The money to be settled is the money has been received, but not yet to the settlement cycle, the display of the local currency to the settlement cycle, the money received in the default settlement to the merchant's account in US dollars.

2.4 Dispute

2.4.1 Resolution Process

2.4.1.1 How often users can initiate disputes

It is usually 180 days, and the specific time limit depends on the card group and the reason for the dispute initiated by the user.

2.4.1.2 Which countries/payment methods can initiate disputes

Cards can generally initiate disputes, while non-cards generally initiate dispute or fraud.

The dispute process is as follows: The user initiates a dispute -> PayerMax notifies the merchant -> the merchant submits defense materials -> PayerMax submits defense materials -> the issuing bank makes a judgment -> PayerMax receives the case result and notifies the merchant.

2.4.1.3 How long will it take to notify the merchant of the outcome of the dispute?

Generally, the dispute will be resolved within 180 days, depending on the channel, country, and payment method.

2.4.1.4 Where can I find disputed orders?

Merchant Platform → page to query disputed orders;

Can feedback PayerMax technical support docking dispute callback interface.

2.4.1.5 Where to upload the defense materials?

Path for uploading defense materials: → , Clik to upload the materials.

2.4.2 Defense materials list and reply

2.4.2.1 What information needs to be responded to in a dispute?(MMC)

The reply information is listed in the body of the dispute email, usually:

User information (user registration information, such as name, UID, mobile phone number, email, IP, etc.)

Order receipt (transaction content, quantity, payment amount, payment currency, user name, etc.)

Consumption information (recharge and consumption details that have not been disputed in the user's history, as well as the current recharge and consumption records) • Shipment records (if any) (logistics list, etc.)

Communication records (if any) (records of communication with users, etc.)

Any other materials that can prove that your company has provided goods/services on time and truthfully

According to the reason for initiating the dispute, the materials that the merchant needs to submit are focused. For details, please refer to the text of the dispute email/the defense material template provided by the merchant platform.

2.4.2.2 If you have already responded to the information before, how do you submit it if you want to add it?

After receiving the dispute email notification, it is recommended to go to the merchant platform to upload the defense documents. Once uploaded, modification is not supported; if you want to add materials within the reply period, you can reply by email; if the reply period exceeds the reply period, it will not be accepted.

2.4.2.3 What happens if the dispute does not respond to the data

If you do not reply to the information, we assume that the merchant accepts the dispute, and the case will be judged as a failure of the merchant, and the frozen funds will be deducted from the merchant and returned to the user.

2.4.2.4 What happens if a dispute is overdue for reply

We will try to provide it to the channel, but if it exceeds the validity period of channel processing, it will be handled as the material that did not reply on time, and the merchant will accept the dispute by default.

2.4.3 Dispute fee

2.4.3.1 What fees will be incurred in case of disputes, who will charge the fees, and can they be refunded if the lawsuit is won?

The channel side will charge a dispute handling fee. Once a dispute occurs, the handling fee will be frozen and will not be refunded regardless of whether the lawsuit is won or lost.

2.4.3.2 Can I choose who will bear the dispute handling fee?

The dispute handling fee is borne by the merchant by default, and the amount of the handling fee will be displayed in the contract, and modification is not supported.

2.4.4 Dispute withdrawn

2.4.4.1 If a user initiates a dispute, and after the merchant communicates with the user, and the user is willing to withdraw the dispute, who can he apply for?

The user can apply to the card issuing bank or wallet to cancel the dispute. After the cancellation, the merchant will inform us, and we will release the frozen funds after verifying that the corresponding dispute has been cancelled.

2.4.4.2 If a user applies to withdraw a dispute, how long will it take to notify the merchant of the result? Will the handling fee be refunded? Will the merchant win the lawsuit?

After the user cancels, the merchant needs to inform us. We will notify the merchant after checking with the channel. The notification time is based on the channel feedback time limit. The handling fee will not be refunded, and the case will be considered successful.

3. Global Disbursement

The merchant can create disbursements via PayerMax merchant dashboard or API depending on what might suit the merchant's business needs.

3.1 Why can't I initiate a disbursement?

Please confirm whether the disbursement contract has been signed. For relevant business information, please contact service@payermax.com.

3.2 Will a handling fee be deducted if a disbursement order fails?

For disbursement failures and refund orders, the order amount and handling fee will be returned to your company's account.

3.3 How to add disbusement approval function?

Please confirm whether your company has enabled the payment approval function. If not, please contact your company administrator to log in to the merchant platform and enter the → page to add the internal approval function. If it has been enabled, please contact your company administrator or other operators with management rights to add permissions for you.For details, please refer to How to open Disbursement Refund Approval process.

3.4 What should I do if the disbursement balance is insufficient?

If the disbursement balance is insufficient, you can recharge your account through the service of the merchant platform and initiate payment again.

3.5 Why is a disbursement request initiated but not tracked in Single Payment?

If you initiate a batch payment application through the merchant platform, a single payment order needs to be approved internally before it can be queried.

3.6 When the merchant's payment currency is a non-local currency and the user's payment currency is a local currency, how can the merchant check the transaction exchange rate?

You can find the exchange rate of the transaction by viewing the specific disbursement order details on the → page, or → page. You can check both the exchange of yours and the exchange of beneficiary's.

3. Local Bank Collection

3.1 What is the currency and period for settlement to PMX account?

Currency for settlement to PMX account: LCY (local currency)

Period for settlement to PMX account: real-time settlement

3.2 What countries and currencies are supported?

Hong Kong (DBS, SCB): USD, CNH, HKD

Indonesia (OCBC): IDR

Philippines (Netbank): PHP

4. Account Management

4.1 Why does the reminder not exist or is not activated when logging into my account?

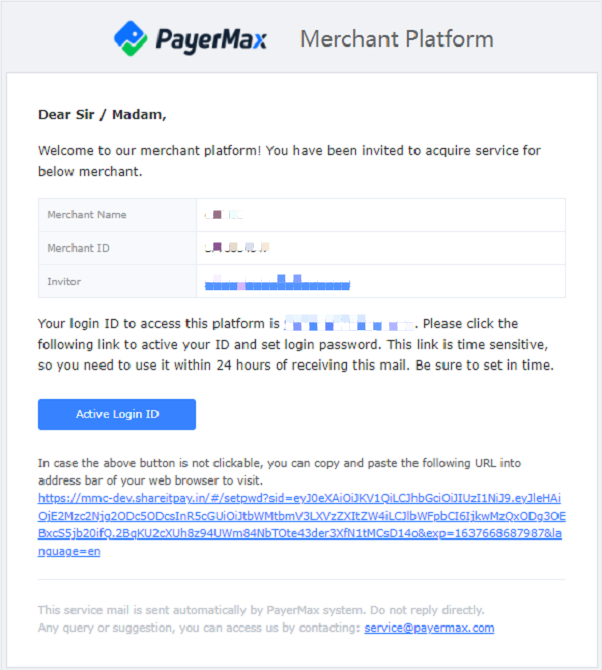

A newly created account needs to be activated before it can be used. After receiving the activation email, please click Activate according to the instructions in the email and set the initial login password.

4.2 What if the activation link is no longer active?

If you do not activate your account within 24 hours of receiving the email, the link will be deactivated to ensure account security. Please contact your operator with administrative privileges to resend the activation email.

4.3 What should I do if I forget my login password?

There is a button at the bottom right corner of the login page, click it to reset your password.

4.4 How do I change my login password?

After entering the merchant platform, click on your avatar in the upper right corner and select the button to enter the change page.

4.5 How to switch merchants?

If an account is bound to multiple merchant accounts, after logging in to the platform, you can switch and view the information under different merchant accounts by clicking the merchant name in the upper right corner of the page. The selection area will highlight the information of the currently selected merchant account.

4.6 Why can't the operator see the newly added merchant account after adding an operator?

The operator needs to log in again to see the newly added merchant account. If you still can't find it after logging in again, please contact our staff.

5. Language & Timezone

5.1 How to switch language?

We support Chinese and English versions for now. You can switch them by 2 ways:

You can find the switch button below the landing page.

You can switch the languages by clicking your avatar after login your account.

5.2 How to check or switch time zones?

There are 2 time zone setting types:

- Control the time zone of the whole platform:

The default time zone is the same with your browser’s. You can set it by clicking your avatar and setting the .

- Control the time zone of the download reports:

When a user exports order information, they can set the time zone in the export table individually. If both the global time zone, search time zone, and export time zone are set at the same time, the export time zone will be used to display the results.

5.3 Why is the page time display inconsistent with others?

Please confirm whether you are in the same time zone as others.

5.4 Why is the report time display inconsistent with others?

Please confirm whether the report time zone is consistent with others.