MMC Batch Disbursement

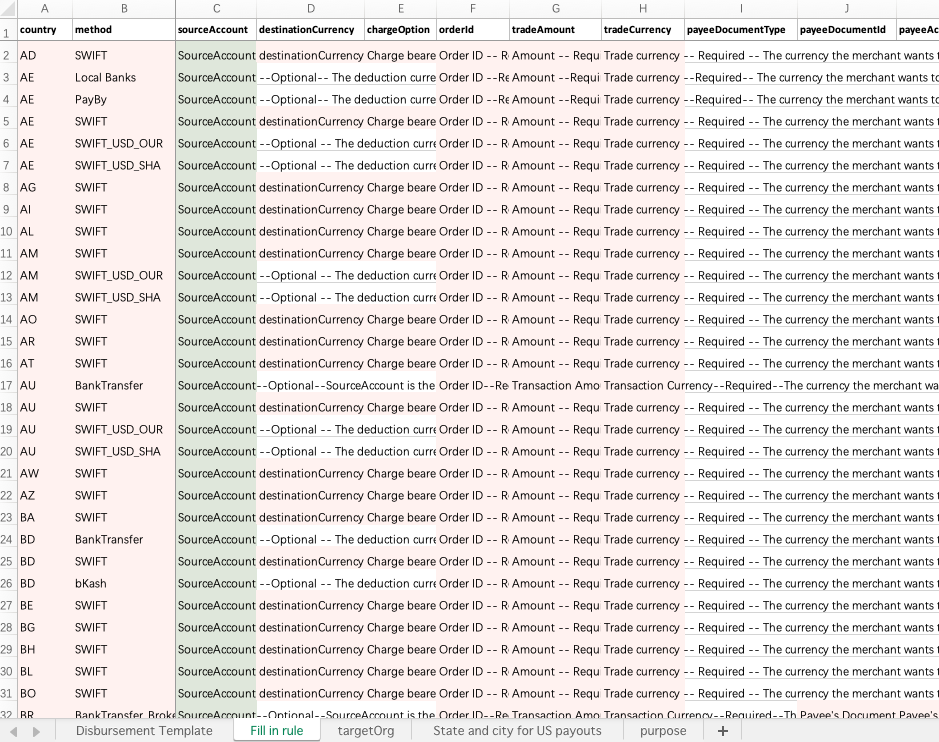

Before initiating a payment, merchants must log in to the PayerMax merchant platform. During the batch file payment process, click , select the payment method, and download the corresponding module version. Refer to the PayerMax requirements for collecting payee and transaction information. The module version provides all required information (pink indicates required fields, green indicates optional fields), information format requirements, and examples of corresponding information. Please complete the required information accordingly.

1. Initiate Batch Transfers

1.1 Batch Transfers Entrance

Enter the payment interface under the merchant platform disbursement management, click on batch transfers to start the payment process.

1.2 Create Batch Transfers

Click to access the payment template (see next step).

After completing all payee and payment information as required, upload the completed payment template.

You can customize the batch reference. This uniquely identifies the batch and is used for approval and search. Duplicate batch numbers are not allowed, otherwise the system will report an error.

You can customize the remark for internal reviewers.

After uploading the payment template, click to complete the creation.

1.3 Generate payment template

- Merchants can select a country and generate a template containing only the payee information fields for that country.

- Merchants can also download blank template containing all fields.

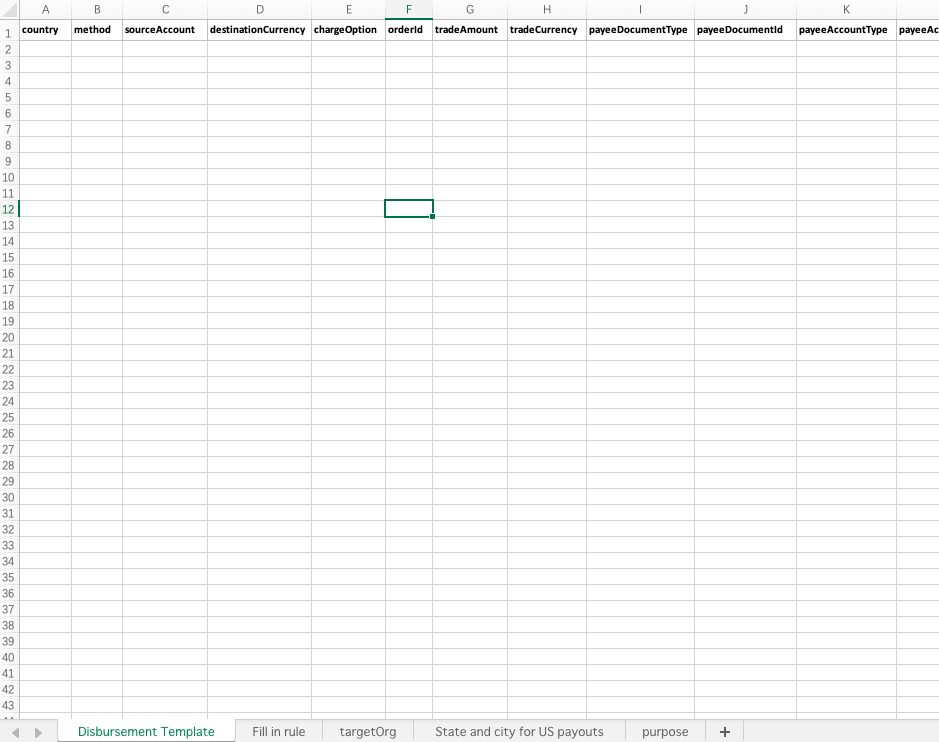

Disbursement Template:

In a blank disbursement template, the "Disbursement Template" page only contains the header.

For the required information and corresponding rules for each payment method, please refer to the "Entry Specifications" page. Collect the payee information and fill in the corresponding fields. Pink indicates required fields, while green indicates optional fields.

Only enter one payee per line in the template. After uploading, the system will verify the information and display the results on the batch query page.

2. View Submitted Batch Transfers

2.1 Batch Payment Query

After creating a batch, return to the Payment screen and click to view the batch's verification status.

When the status is Validated, click the Batch column to access batch details and view approved orders. Once verified, submit transactions in the batch that have passed verification. If you click , transactions that failed to be parsed will not be executed.

2.2 Batch Detail

- Merchants can view the source amount, trade amount, exchange rate, fee, total order and estimated to receive on the batch details page.

3. Payment Approval

3.1 Batch Approval

After submitting a batch, if an approval mechanism is set up, users with approval permissions will receive an email notification. They will then need to access the Payment Approval interface and click to view the batch information.

This interface allows you to view Creation Time, Batch Status, SubMerchant, Batch Reference, File Name, Total Orders, Successful Parsing Count, Failed Parsing Count, Total Payment Amount, and Description.

Merchants can click to view further information.

3.2 Payment Approval

- Approver can check deduction amount, transaction amount, exchange rate, fees, number of transactions and estimated amount to be received by the payer on the payment approval page, and can choose to reject or approve after confirmation.

4. Status Query

4.1 Batch Status

In the batch query interface, you can view the processing status of all batches.

Created: The batch has been uploaded successfully and is awaiting PayerMax verification.

Validated: PayerMax verification is complete. Click to view details of which transactions have passed and which have failed verification. After verification is complete, if verification is passed or partially passed, the batch can be submitted for payment (only transactions that have passed verification will be released). If not submitted, the transactions in the batch will not be processed.

Pending Approval: The batch is awaiting approval by the merchant's designated internal reviewer. Transactions can only be released after approval. Approver can approve transactions in a batch on the query interface.

Processing: The transaction has entered the processing state. Some orders in the batch have not yet reached a final status.

Success: All individual orders in the batch have reached a final status: Success/Failure/Refund.

| Status | Description | Possible Operations |

| Created | Batch payment file has been uploaded and is being verified. | / |

| Validated | Batch payment file has been verified and is ready for submission (non-whole order verification failed) | Submit Batch/Delete |

| Pending Approval | Operators with approval authority conduct payment approval | Approved/Rejected/Deleted |

| Processing | Batch payment application platform has been accepted | / |

| Success | The channel has been successfully accepted (the actual payment result shall prevail) | / |

| Failure | If the payment is rejected, you can view the reason for the rejection on the payment details page. | Download original file/delete |

4.2 Order Status

Click on a specific batch to view the status of each payment in the batch

| Status | Description | Possible Operations |

| Pending Approval | All orders in this batch have not been approved by the customer's internal approver and have not been processed. | Approved/Rejected/Deleted |

| Pending Recharge | The merchant's balance is insufficient to support this transaction and requires a top-up before further processing. | / |

| Processing | The transaction has entered the processing state and has not yet reached the final state. | / |

| Pending Materials | If the transaction hits the risk control rules, you need to submit supporting documents. | Supplementary material |

| Materials Under Review | PayerMax has received the materials and is reviewing them. | / |

| Success | The channel has been successfully accepted (the actual payment result shall prevail) | / |

| Failure | If the payment is rejected, you can view the reason for the rejection on the payment details page. | / |

| Bounceback | A successful transaction is eventually returned by the payment institution and updated to failure (returned). | / |